Online Classroom Batches Preferred

Weekdays Regular

(Class 1Hr - 1:30Hrs) / Per Session

Weekdays Regular

(Class 1Hr - 1:30Hrs) / Per Session

Weekend Regular

(Class 3hr - 3:30Hrs) / Per Session

Weekend Fasttrack

(Class 4:30Hr - 5:00Hrs) / Per Session

No Interest Financing start at ₹ 5000 / month

Top Skills You Will Gain

- Financial Management

- General Ledger Accounting

- Account Payables

- Account Receivables

- Cash Management

- Fixed Assets Management

- Expense Management

- Tax Management

Oracle Fusion Financial Course Key Features 100% Money Back Guarantee

-

5 Weeks Training

For Become a Expert -

Certificate of Training

From Industry Oracle Fusion Financial Experts -

Beginner Friendly

No Prior Knowledge Required -

Build 3+ Projects

For Hands-on Practices -

Lifetime Access

To Self-placed Learning -

Placement Assistance

To Build Your Career

Top Companies Placement

Our Oracle Fusion, Financial placement program, offers a seamless recruitment process, guaranteeing that companies acquire proficient professionals skilled in implementing and enhancing Oracle Fusion Financial solutions. Graduates enrolled in our program can anticipate lucrative pay packages, complemented by the potential for significant salary enhancements facilitated through our robust placement assistance.

- Designation

-

Annual SalaryHiring Companies

Oracle Fusion Financial Course Curriculum

Trainers Profile

At Learnovita, our Oracle Fusion Financial trainers are seasoned professionals, holding certifications and boasting substantial experience gained from prominent multinational firms. Committed to excellence, they impart comprehensive knowledge and industry-leading practices to learners. Our trainers are dedicated to preparing individuals for success in today's competitive job market, providing them with the latest insights and skills essential for excelling in Oracle Fusion Financial.

Syllabus of Oracle Fusion Financial Online Course Download syllabus

- Fusion - Technology architecture

- User and Roles security

- Multi Org structure

- Offerings

- Add Assets

- Add Multiple Assets

- Add Leased Assets

- Creating a Leased Asset

- Terminating a Lease

- Lease Liability on Terminated Leases

- Create Procurement agents

- Invoice options configurations

- Payable options configurations

- Setting up supplier Number

- Asset Key Flexfield

- Location Flexfield

- System Controls

- Receivable system configurations

- Auto accounting configuration

- Memo lines creation

- Oracle Fusion Cash Management

- Manual Bank statement creation

- Asset configuration definition

- Configure system controls

- Create asset calendar

- Manage asset book

- Role creation

- User Creation

- Role assignment

- Data Access

- Configure the Chart of Accounts

- Explain Essbase

- Set up accounting hierarchies

- Set up the accounting calendar

- Configure Chart of Accounts Security

- Create and manage Accounting Rules

- Create and process sub-ledger accounting entries

- Explain the journal description rules

- Identify supporting references

- Process journal entries

- Configure automated journal processing

- Explain the journal approval setup

- Configure allocations and periodic entries

- Explain the secondary ledger and reporting currencies

Contact Us

+91 9176954999

(24/7 Support)

Request for Information

Industry Projects

Mock Interviews

- Mock interviews by Learnovita give you the platform to prepare, practice and experience the real-life job interview. Familiarizing yourself with the interview environment beforehand in a relaxed and stress-free environment gives you an edge over your peers.

- In our mock interviews will be conducted by industry best Oracle Fusion Financial Training in Bangalore experts with an average experience of 7+ years. So you’re sure to improve your chances of getting hired!

How Learnovita Mock Interview Works?

Oracle Fusion Financial Training Objectives

- Oracle Fusion Applications

- Oracle Cloud ERP

- Oracle Financials Cloud

- Related modules

- Enhanced automation through artificial intelligence and machine learning

- Expanded integration capabilities with other enterprise systems

- The incorporation of advanced analytics for real-time decision-making

- Configuration settings

- Navigation within the application

- Integration with other modules

- Security permissions troubleshooting

- General Ledger

- Accounts Payable

- Accounts Receivable

- Cash Management

- Fixed Assets

- Financial Reporting

Exam & Certification

- Tangible proof of expertise

- Giving certified individuals added credibility in the eyes of employers

- Clients

- Peers within the finance and ERP community

- Oracle Fusion Financial Certification offers several benefits

- Including validation of expertise in Oracle's financial management solutions

- Enhanced career opportunities in finance and ERP roles

- Increased credibility with employers and clients, access to specialized training resources, and potential for higher salaries and promotions

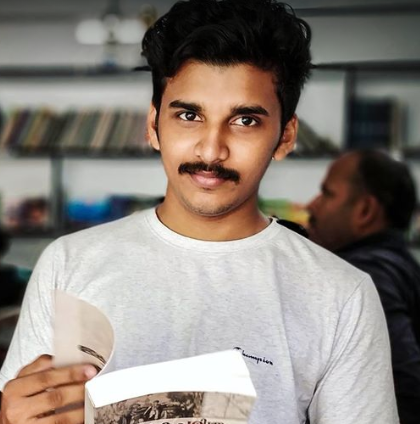

Recently Placed Students

Pranav Srinivas

Software Testing, CapgeminiOracle Fusion Financial Online Course FAQ's

- LearnoVita is dedicated to assisting job seekers in seeking, connecting, and achieving success, while also ensuring employers are delighted with the ideal candidates.

- Upon successful completion of a career course with LearnoVita, you may qualify for job placement assistance. We offer 100% placement assistance and maintain strong relationships with over 650 top MNCs.

- Our Placement Cell aids students in securing interviews with major companies such as Oracle, HP, Wipro, Accenture, Google, IBM, Tech Mahindra, Amazon, CTS, TCS, HCL, Infosys, MindTree, and MPhasis, among others.

- LearnoVita has a legendary reputation for placing students, as evidenced by our Placed Students' List on our website. Last year alone, over 5400 students were placed in India and globally.

- We conduct development sessions, including mock interviews and presentation skills training, to prepare students for challenging interview situations with confidence. With an 85% placement record, our Placement Cell continues to support you until you secure a position with a better MNC.

- Please visit your student's portal for free access to job openings, study materials, videos, recorded sections, and top MNC interview questions.