Exploring the Overview of the Tally Course

The Tally Online Training is designed to provide individuals with a solid understanding of Tally software, focusing on accounting inventory management, and financial reporting . Tally Online Course offers various learning formats, including self-paced module and instructor-led training catering to different learning styles Enrolling in accounting software but also increases your employability making you highly sought-after by businesses in need of Tally-certified professional. Completing the Tally course and gaining certification boosts your career prospects opening door to role in finance and accounting across diverse industries Tally Certification Course also provide valuable exposure to practical application helping to financial data and business operations.

Additional Info

Upcoming Future Transformations in Tally Course

- Cloud-Based Accounting Solutions:

The future of Tally will see increased integration with cloud technology, allowing businesses to access their financial data remotely Cloud-based Tally solutions provide flexibility and scalability enabling users to access their data from anywhere in the world This trend is set to transform small and medium-sized enterprises (SMEs) by offering cost-effective accounting solution Cloud technology also ensures real-time updates and collaboration between multiple users, enhancing operational efficiency.

- Automation of Financial Processes:

The automation in accounting ensures greater accuracy minimizes manual error and reduce the time spent on routine task. Automation can also help businesses stay compliant ever-changing tax laws and regulation By automating repetitive tasks Tally users will focus on higher-value task such as strategic decision-making.

- Integration with E-Way Bill Generation:

In the coming years Tally will further enhance its capabilitie to integrate seamlessly with government portals for e-way bill generation. The growing requirement for businesses to comply with government regulations such as GST will make this feature indispensable. Tally’s integration with e-way bill systems will reduce paperwork improve compliance and streamline the transportation process. Tally professionals will be required to understand the process of generating e-way bills within the software and using them in various business operations. Training in these integration will be critical for professionals aiming to stay competitive in the accounting sector.

- Advanced Reporting and Analytics:

Tally's future versions will feature advanced reporting and analytics capabilities enabling businesses to make data-driven decision. By using integrated financial reports and dashboards, companies will be able to analyze their profitability, cash flows and inventory more efficiently. Tally users will be trained in advanced tools that offer deeper insights into business trends, helping organizations predict future financial outcomes. As businesses become more data-driven proficiency in advanced reporting in Tally will become a key skill for accountants and finance professional. Training in these tools will be integral for anyone looking to enhance their financial reporting capabilities.

- Mobile Access for Accounting:

Mobile access increasingly becoming a vital trend in the world of business accounting to manage their finances This will significantly improve the accessibility of financial data and make real-time updates easier Tally online training will focus these mobile solutions in daily accounting tasks helping professionals maintain productivity.

- Blockchain Integration in Accounting:

Blockchain technology is set to accounting by providing secure transparent financial record Tally will explore integrating blockchain for enhanced security transaction management and audit trails. As the demand for blockchain in financial applications grows Tally training will include modules that teach professionals how to manage blockchain-enabled accounting system. Blockchain’s role in Tally will become a critical focus for future accountants looking to leverage the technology.

- Artificial Intelligence (AI) for Financial Decision-Making:

Artificial intelligence is making its way into the accounting space and Tally is poised to integrate AI for better decision-making and financial forecasting AI can analyze patterns in financial data and make predictive analyses which can help businesses plan their budgets and strategies. Tally users will learn to harness AI tools to automate decision-making processes reducing the human effort required for complex financial analysis. With AI improving efficiency, accountants will focus on interpreting AI-generated insights rather than manually conducting analyses.

- Tax Compliance and GST Updates:

As tax regulations continue to evolve, Tally will update its software to remain compliant with changes in GST and other tax law. The need for Tally professionals to keep up with these changes will grow, and training will focus on understanding new tax rules, filing returns and integrating with government systems. With automatic tax calculation features, businesses will be able to stay compliant with minimal manual intervention. Tally users will also learn how to adjust software settings to accommodate new tax regulations. These developments will ensure that accountants are always prepared for changes in tax laws.

- Data Security and Privacy Features:

With increasing concerns over data security, Tally will continue to enhance its features related to data encryption, secure logins, and protection of sensitive financial data. Future versions of Tally will focus on ensuring that businesses meet compliance standards such as GDPR, while safeguarding their financial information Tally professionals will need to understand the importance of securing data implementing secure access controls, and maintaining privacy standards. Training in these security features will become essential as businesses prioritize protecting their financial information from cyber threats Tally users will be equipped with the tools to prevent unauthorized access and data breaches.

- Integration with Third-Party Software:

As businesses rely on various third-party software solutions, Tally will increasingly offer integrations with popular software tools such as CRM and inventory management system This will allow seamless data sharing between Tally and other business applications, improving operational efficiency Tally professionals will learn how to manage these integrations and ensure data consistency across platform. Future Tally training programs will emphasize how to set up and troubleshoot integration.

Understanding Tools and Technologies for Tally Course

- Tally ERP 9:

Tally ERP 9 is one of the most widely used accounting software that offers a complete suite of financial management tools. It enables businesses to handle accounting, inventory management, taxation and payroll processing seamlessly The tool is user-friendly, making it ideal for both small businesses and large enterprises Tally ERP 9 allows integration with other business software and provides easy access to financial reports. Professionals learning Tally ERP 9 gain hands-on experience in handling various business functions like ledger management, billing and tax calculations.

- Tally Prime:

Tally Prime is Tally software offering an intuitive interface and a modern design. It simplifies business processes by automating tasks like inventory management, banking, and accounting. With enhanced features like remote access and multi-user support, it helps businesses scale operations effectively. The software also provides advanced reporting tools for better decision-making. Tally Prime is designed to ensure smooth GST compliance helping businesses manage taxes easily.

- Tally Digital Signature:

Digital Signature in Tally helps businesses in the authentication of electronic documents invoices and tax returns This tool ensures secure transactions and essential for organization needing to comply with regulatory requirements. By using Tally Digital Signature, professionals can digitally sign business documents and reduce paperwork The integration with GST returns allows seamless e-filing of documents directly from the Tally software. This tool is highly beneficial for accountants who want to enhance efficiency and reduce the risk of fraud in the digital transaction process.

- Tally Audit & Compliance:

Tally's Audit & Compliance tool helps businesses perform internal audits and maintain financial integrity. The tool enables professionals to track any discrepancies in financial records ensuring compliance with tax regulations like GST and VAT It helps in identifying and resolving errors in accounting books quickly thus maintaining transparency This tool is crucial for accountants and auditors focusing on accuracy and timely tax reporting.

- Tally Customization:

Tally Customization allow businesses to tailor the software according to their unique requirements. Whether it's modifying invoice templates or configuring reports, this tool helps businesses create solutions that match their operational need. Learning this tool empowers Tally users to develop specific features without needing extensive programming skill. Customized functionalitie are crucial for businesses with specific reporting and accounting need.

- Tally Data Synchronization:

Tally Data Synchronization enables businesses to synchronize data across multiple locations ensuring consistency and real-time access. This tool are essential for businesses operating in multiple branches or locations, as it helps maintain centralized financial records. Professionals can use Tally Data Synchronization to transfer data like transactions, stock movements and customer details securely. Mastering data synchronization in Tally ensures seamless operations across businesses with distributed teams.

- Tally GST Compliance:

Tally GST Compliance tool are specifically designed to help businesses manage Goods and Services Tax (GST) efficiently With built-in features like GST invoicing GST returns filing and tax calculations, it simplifies the entire GST process This tool ensures that all transactions are accurately captured for GST reporting, minimizing the risk of error Professionals using Tally GST Compliance tools can generate GST-compliant invoices and file returns directly from the software.

- Tally Payroll:

Tally Payroll is a comprehensive solution for managing employee salaries, benefits, and statutory compliance in businesses of all sizes. This tool automates payroll calculations, including deductions, bonuses, and tax computation, helping businesses save time. It also ensures compliance with various statutory requirements such as Provident Fund (PF) and Employee State Insurance (ESI) Tally Payroll can generate payslips, reports and other documentation required by HR departments.

Exploring the Roles and Responsibilities of a Tally Course

- Accountant:

An accountant using Tally is responsible for recording financial transactions, maintaining ledgers, and ensuring accurate financial reporting. They use Tally for daily accounting activities such as creating invoices, journal entries, and maintaining accounts payable and receivable. Tally allows accountants to track expenses, income, taxes, and payroll, ensuring all records comply with local regulations. They also work closely with auditors to ensure financial transparency and integrity within the organization.

- Tax Consultant:

A tax consultant working with Tally ensures that the organization complies with tax regulations including VAT, GST and income tax. They use Tally built-in tax calculation tools to help businesses generate tax-compliant invoices and file returns accurately. Tax consultants review financial records to determine taxable income and ensure the appropriate tax is applied. They also stay updated with tax laws and help businesses optimize their tax liability through efficient reporting.

- Tally Trainer:

A Tally trainer is responsible for providing training to new users on Tally software, covering its accounting, inventory and payroll features. They design training programs and ensure that the trainees gain hands-on experience by using Tally in real-world scenario. Trainers help employees understand key features of Tally such as GST compliance, reporting tools, and data synchronization. They assess the progress of trainees and provide one-on-one support to ensure that all concepts are understood clearly. Tally trainers also create tutorial materials and provide updates on any new Tally versions or features.

- Payroll Manager:

A payroll manager working with Tally is responsible for managing employee payroll processing and ensuring timely salary distribution They use Tally Payroll to calculate salaries, bonuse, and deductions for employees, and ensure compliance with statutory requirements like Provident Fund (PF) and Employee State Insurance (ESI). The role also includes generating payslips, managing attendance, and calculating tax deductions for employees Payroll managers ensure that all payroll-related data is maintained securely and accurately in Tally.

- Inventory Manager:

An inventory manager utilizes Tally for tracking stock levels, purchases, and sales. They maintain and update stock records in Tally to ensure that inventory level are optimized and that there are no shortages or overstocking Inventory managers use Tally’s stock management features to track product movement, manage stock transfers and generate reports. They are assist in auditing inventory and streamlining the procurement process through Tally’s automation tools.

- Financial Analyst:

A financial analyst uses Tally for generating reports and analyzing the financial health of a business. They also evaluate financial performance using Tally’s financial data, identifying trends, risks, and opportunities. Financial analysts help management in decision-making by providing insights derived from Tally data regarding business profitability cost control, and resource allocation.

- Tally Support Specialist:

A Tally support specialist provides technical assistance to users by troubleshooting issues related to Tally software. They help with installation, configuration and software updates ensuring the system runs efficiently Tally support specialists assist businesses in resolving issues related to data backup tax compliance and report generation. They provide ongoing support for system errors or crashes and ensure the smooth running of business operation Additionally, they guide users through advanced features such as Tally customization and integration with other software.

- Audit Manager:

An audit manager utilizing Tally ensures that the organization financial records are accurate industry standards. They oversee the audit process using Tally to review accounts, detect discrepancies, and identify areas of financial concern. Audit managers prepare financial statements for auditing ensuring that all data entered into Tally complies with accounting standards. They also work closely with internal and external auditors to ensure transparency in financial reporting.

- Accounts Payable Clerk:

An accounts payable clerk responsible for processing and managing the company’s outstanding bills and payments using Tally. They ensure that invoices from vendors and suppliers are entered accurately into Tally, facilitating timely payment The clerk manages purchase orders and verifies that payments are made according to agreed term. They generate reports in Tally to keep track of accounts payable and ensure that records are up to date.

- Accounts Receivable Clerk:

An accounts receivable clerk uses Tally to manage incoming payments and maintain accurate record of customer transaction They ensure that all invoices are sent to customers on time and that payments are properly recorded in the system. The clerk follows up with customers for overdue payments and ensures timely collection of outstanding debt. They generate accounts receivable reports in Tally and keep track of cash inflows, assisting in cash flow management.

Best Companies Seeking Tally Talent for Innovation

- Tata Consultancy Services (TCS):

Tata Consultancy Services is IT services companies that regularly hires Tally professionals for its finance and accounting projects. Tally professionals at TCS work on optimizing financial workflows and ensuring timely reporting and compliance They also leverage Tally for data analysis, helping clients gain insights into financial performance. TCS offers a dynamic work environment with exposure to a variety of industries allowing Tally professionals to grow in their careers.

- Infosys:

Infosys is IT services industry that accounting automation and enterprise resource planning solution They provide clients with end-to-end solutions that often require Tally’s tools for efficient financial management. The company fosters innovation in its projects, allowing professionals to apply Tally’s functionalities in creative ways to optimize business operation Infosys also invests in the development of its employees, ensuring continuous skill enhancement and exposure to cutting-edge technologies.

- Wipro:

Wipro hires Tally professionals to support its large client base with finance automation and accounting solutions. The company utilizes Tally to enhance business efficiency and ensure seamless financial operations across its global network Tally experts at Wipro work on projects that help clients manage their finances better and comply with local regulations. The company offers diverse opportunities for Tally professionals, from financial consulting to system implementation and support Wipro’s innovative work culture provides a collaborative environment for professionals to grow and contribute to major industry advancements.

- Accenture:

Accenture recruits Tally-certified professionals for its business consulting projects that involve finance and accounting system integration. The company leverages Tally for automating financial processes and improving business insights through real-time financial data Tally experts at Accenture contribute to transforming business operations for clients by optimizing financial workflows and ensuring compliance Accenture values professionals who bring fresh perspectives to financial technology, allowing Tally specialists to implement creative solution The company’s global presence and diverse client base offer vast career growth opportunities for Tally professional.

- KPMG:

KPMG regularly hires Tally professionals to support its accounting and auditing services. They use Tally to streamline financial audits, tax filings, and financial reporting processes for clients across various industrie. Tally experts at KPMG play in ensuring the accuracy of financial records and improving the overall efficiency of accounting systems. They are responsible for helping clients maintain compliance with tax regulations and improve financial transparency. KPMG offers exciting opportunities for Tally professionals to expand their expertise in accounting and finance while working on high-profile projects.

- Ernst & Young (EY):

Ernst & Young seeks Tally-certified professionals to manage their accounting and financial advisory services EY utilizes Tally to help clients automate accounting functions, reduce manual errors, and ensure timely reporting Tally professionals at EY work closely with clients to customize financial reporting solutions and improve overall business performance. EY’s global presence provides Tally professionals with opportunitie to work on diverse projects. The company emphasizes continuous learning and offers career advancement opportunities for Tally professionals to grow within the organization.

- Deloitte:

Deloitte recruits Tally professionals to provide financial solutions to their clients, focusing on accounting automation and financial reporting. The company uses Tally to help clients streamline their finance operations and enhance decision-making with accurate real-time data Tally experts at Deloitte assist in optimizing financial workflows ensuring compliance with regulations, and improving business efficiency The company’s consulting arm offers Tally professionals a wide range of opportunities to work on high-impact projects with global clients.

- HDFC Bank:

HDFC Bank hires Tally-certified professionals for managing its internal accounting processes and providing financial services to clients. The bank uses Tally for its accounting and payroll functions, as well as ensuring regulatory compliance with tax authorities. Tally experts at HDFC Bank work on optimizing financial workflows ensuring transparency, and helping the bank achieve efficiency in its day-to-day financial operations. The bank’s wide range of financial product and services provides Tally professional career opportunities.

- ICICI Bank:

ICICI Bank actively recruits Tally professionals to support its financial operations, including accounting, reporting, and tax compliance. Tally is used within the bank for managing internal records, generating reports, and ensuring accurate financial reporting Tally experts help the bank stay compliant with financial regulations and manage financial data across various department. The bank’s global reach and wide range of services provide Tally professionals with opportunities to grow and make a significant impact on the company financial operation ICICI Bank invests in its employees, ensuring Tally professionals can advance their careers through skill development and exposure to industry best practices.

- Reliance Industries:

Reliance Industries seeks Tally professionals to optimize its accounting and financial reporting processes across its vast business operation The company utilize Tally for managing inventory, accounting transactions, and ensuring tax compliance in its large-scale operation Tally experts at Reliance help improve business processes by integrating Tally with other financial systems and automating key financial function The company’s diversified business interests provide Tally professionals with the opportunity to work across various sectors including retail manufacturing and energy.

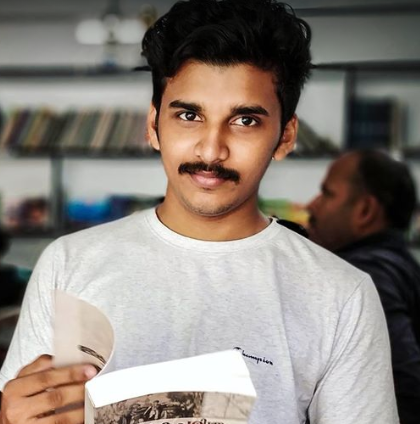

Regular 1:1 Mentorship From Industry Experts

Regular 1:1 Mentorship From Industry Experts