- Understanding Agile Methodologies and Principles | A Complete Tutorial

- What is a Work Breakdown Structure (WBS)? | Learn Overview, Steps, Benefits

- Traditional Project Management Tutorial | A Comprehensive Guide

- Total Quality Management (TQM): Complete Guide [STEP-IN]

- Total Productive Maintenance Tutorial | Get an Overview

- Virtual Team Tutorial – Learn Origin, Definition and its Scope

- The Rule of Seven in Project Management – Tutorial

- Make or Buy Decision – A Derivative Tutorial for Beginners

- What is Halo Effect? | Learn More through Tutorial

- Balanced Score Card Tutorial | Learn with Definition & Examples

- What is Supply Chain Management? | Tutorial with Examples

- Succession Planning Tutorial | A Complete Guide with Definitions

- What is Structured Brainstorming? | Quickstart & Learn the Tutorial

- Stress Management Tutorial | A Comprehensive Guide for Beginners

- What is a Statement of Work? | Learn with Definition & Examples

- What is Stakeholder Management? – The Ultimate Guide for Beginners

- How to Create a Staffing Management Plan? | Learn from Tutorial

- What is Resource Leveling? | A Comprehensive Tutorial

- Requirements Collection Tutorial: Gather Project Needs

- What Is a RACI Chart? | Learn with Example & Definitions

- Quality Assurance vs Quality Control: Tutorial with Definitions & Differences

- Project Workforce Management Tutorial | A Definitive Guide

- Project Time Management Tutorial: Strategies, Tips & Tools

- Project Management Success Criteria Tutorial | Understand and Know More

- Identify Risk Categories in Project Management | A Comprehensive Tutorial

- Project Records Management Tutorial | Quickstart -MUST READ

- Project Quality Plan (PQP) Tutorial | Ultimate Guide to Learn [BEST & NEW]

- Project Portfolio Management | A Defined Tutorial for Beginners

- Goals of a Project Manager Tutorial | The Ultimate Guide

- Project Management Triangle Tutorial: What It Is and How to Use

- Project Management Tools Tutorial | Learn Tools & Techniques

- What is PMO (project management office)? | A Complete Tutorial from Scratch

- Project Management Lessons | Learn in 1 Day [ STEP-IN ]

- What is a Project Kickoff Meeting? | Learn Now – A Definitve Tutorial

- Project Cost Management Tutorial | Steps, Basics, and Benefits

- Types of Contracts in Project Management | Learn with Examples

- Project Activity Diagram | Ultimate Guide to Learn [BEST & NEW]

- What is Project Procurement Management? | Tutorial Explained

- Procurement Documents Tutorial | The Ultimate Guide

- Process-Based Project Management Tutorial: A Beginner’s Guide

- What Is PRINCE2 Project Management? | A Definitive Tutorial for Beginners

- Effective Presentation Skills – Learn More through Tutorial

- Powerful Leadership Skills Tutorial | The Ultimate Guide

- PERT Estimation Technique Tutorial | Explained with Examples

- Pareto Chart Tool Tutorial | Learn Analysis, Diagram

- Organizational Structure Tutorial: Definition and Types

- Negotiation Skills for Project Management | Learn from the Basics

- Monte Carlo Analysis in Project Management Tutorial | A Perfect Guide to Refer

- Effective Management Styles Tutorial | The Ultimate Guide

- Management by Objectives (MBO) Tutorial | Overview, Steps, Benefits

- Leads, Lags & Float – Understand the Difference through Tutorial

- What is Knowledge Management? – Tutorial Explained

- What is Just-in-Time Manufacturing (JIT)? | Know More through Tutorial

- Gantt Chart Tool Tutorial: The Ultimate Guide

- Extreme Project Management Tutorial – Methodology & Examples

- Introduction for Event Chain Methodology Tutorial | Guide For Beginners

- Enterprise Resource Planning (ERP) | A Complete Tutorial for Beginners

- What Is Design of Experiments (DOE)? | Learn Now – A Definitve Tutorial

- Decision Making Tutorial – Know about Meaning, Nature, Characteristics

- Critical Path Method Tutorial | How to use CPM for project management

- What is Critical Chain Project Management? | A Complete Tutorial

- What is Conflict Management? | Learn the Definition, styles, strategies through Tutorial

- Effective Communication Skills Tutorial – Definitions and Examples

- Communication Models Tutorial – Project Management

- Methods of Communication Tutorial | A Complete Learning Path

- Communication Management Tutorial | Know more about Plans & Process

- What are Communication Channels? | Learn Now Tutorial

- Communication Blocker Tutorial | Explained with Examples

- Cause and Effect Diagrams Tutorial | The Ultimate Guide

- What is Benchmarking? | Technical & Competitive Tutorial

- Seven Processes of Prince2 Tutorial | Everything you Need to Know

- Design Thinking Tutorial – Quick Guide For Beginners

- What is Performance Testing | A Complete Testing Guide With Real-Time Examples Tutorial

- What is Confluence? : Tutorial For Beginners | A Complete Guide

- Lean Six Sigma Tutorial

- Agile Scrum Tutorial

- PMI-RMP Plan Risk Management Tutorial

- Designing the Blueprint Delivery Tutorial

- What is Confluence? : Tutorial For Beginners | A Complete Guide

- Program Benefits Management Tutorial

- Continuous Improvement – Agile Value Stream Mapping

- Program Organization Tutorial

- Risk and Issue Management Tutorial

- Project Integration Management Tutorial

- Planning and Control Tutorial

- Program Management Principles Tutorial

- program strategy Alignment Tutorial

- PMP Tutorial

- Program Governance Tutorial

- Program Life Cycle Management Tutorial

- PMP Exam Preparation Tutorial

- PMI-PgMP Tutorial

- Agile Methodologies and Frameworks- Kanban and Lean Management Tutorial

- JIRA Tutorial

- Primavera P6 Tutorial

- Understanding Agile Methodologies and Principles | A Complete Tutorial

- What is a Work Breakdown Structure (WBS)? | Learn Overview, Steps, Benefits

- Traditional Project Management Tutorial | A Comprehensive Guide

- Total Quality Management (TQM): Complete Guide [STEP-IN]

- Total Productive Maintenance Tutorial | Get an Overview

- Virtual Team Tutorial – Learn Origin, Definition and its Scope

- The Rule of Seven in Project Management – Tutorial

- Make or Buy Decision – A Derivative Tutorial for Beginners

- What is Halo Effect? | Learn More through Tutorial

- Balanced Score Card Tutorial | Learn with Definition & Examples

- What is Supply Chain Management? | Tutorial with Examples

- Succession Planning Tutorial | A Complete Guide with Definitions

- What is Structured Brainstorming? | Quickstart & Learn the Tutorial

- Stress Management Tutorial | A Comprehensive Guide for Beginners

- What is a Statement of Work? | Learn with Definition & Examples

- What is Stakeholder Management? – The Ultimate Guide for Beginners

- How to Create a Staffing Management Plan? | Learn from Tutorial

- What is Resource Leveling? | A Comprehensive Tutorial

- Requirements Collection Tutorial: Gather Project Needs

- What Is a RACI Chart? | Learn with Example & Definitions

- Quality Assurance vs Quality Control: Tutorial with Definitions & Differences

- Project Workforce Management Tutorial | A Definitive Guide

- Project Time Management Tutorial: Strategies, Tips & Tools

- Project Management Success Criteria Tutorial | Understand and Know More

- Identify Risk Categories in Project Management | A Comprehensive Tutorial

- Project Records Management Tutorial | Quickstart -MUST READ

- Project Quality Plan (PQP) Tutorial | Ultimate Guide to Learn [BEST & NEW]

- Project Portfolio Management | A Defined Tutorial for Beginners

- Goals of a Project Manager Tutorial | The Ultimate Guide

- Project Management Triangle Tutorial: What It Is and How to Use

- Project Management Tools Tutorial | Learn Tools & Techniques

- What is PMO (project management office)? | A Complete Tutorial from Scratch

- Project Management Lessons | Learn in 1 Day [ STEP-IN ]

- What is a Project Kickoff Meeting? | Learn Now – A Definitve Tutorial

- Project Cost Management Tutorial | Steps, Basics, and Benefits

- Types of Contracts in Project Management | Learn with Examples

- Project Activity Diagram | Ultimate Guide to Learn [BEST & NEW]

- What is Project Procurement Management? | Tutorial Explained

- Procurement Documents Tutorial | The Ultimate Guide

- Process-Based Project Management Tutorial: A Beginner’s Guide

- What Is PRINCE2 Project Management? | A Definitive Tutorial for Beginners

- Effective Presentation Skills – Learn More through Tutorial

- Powerful Leadership Skills Tutorial | The Ultimate Guide

- PERT Estimation Technique Tutorial | Explained with Examples

- Pareto Chart Tool Tutorial | Learn Analysis, Diagram

- Organizational Structure Tutorial: Definition and Types

- Negotiation Skills for Project Management | Learn from the Basics

- Monte Carlo Analysis in Project Management Tutorial | A Perfect Guide to Refer

- Effective Management Styles Tutorial | The Ultimate Guide

- Management by Objectives (MBO) Tutorial | Overview, Steps, Benefits

- Leads, Lags & Float – Understand the Difference through Tutorial

- What is Knowledge Management? – Tutorial Explained

- What is Just-in-Time Manufacturing (JIT)? | Know More through Tutorial

- Gantt Chart Tool Tutorial: The Ultimate Guide

- Extreme Project Management Tutorial – Methodology & Examples

- Introduction for Event Chain Methodology Tutorial | Guide For Beginners

- Enterprise Resource Planning (ERP) | A Complete Tutorial for Beginners

- What Is Design of Experiments (DOE)? | Learn Now – A Definitve Tutorial

- Decision Making Tutorial – Know about Meaning, Nature, Characteristics

- Critical Path Method Tutorial | How to use CPM for project management

- What is Critical Chain Project Management? | A Complete Tutorial

- What is Conflict Management? | Learn the Definition, styles, strategies through Tutorial

- Effective Communication Skills Tutorial – Definitions and Examples

- Communication Models Tutorial – Project Management

- Methods of Communication Tutorial | A Complete Learning Path

- Communication Management Tutorial | Know more about Plans & Process

- What are Communication Channels? | Learn Now Tutorial

- Communication Blocker Tutorial | Explained with Examples

- Cause and Effect Diagrams Tutorial | The Ultimate Guide

- What is Benchmarking? | Technical & Competitive Tutorial

- Seven Processes of Prince2 Tutorial | Everything you Need to Know

- Design Thinking Tutorial – Quick Guide For Beginners

- What is Performance Testing | A Complete Testing Guide With Real-Time Examples Tutorial

- What is Confluence? : Tutorial For Beginners | A Complete Guide

- Lean Six Sigma Tutorial

- Agile Scrum Tutorial

- PMI-RMP Plan Risk Management Tutorial

- Designing the Blueprint Delivery Tutorial

- What is Confluence? : Tutorial For Beginners | A Complete Guide

- Program Benefits Management Tutorial

- Continuous Improvement – Agile Value Stream Mapping

- Program Organization Tutorial

- Risk and Issue Management Tutorial

- Project Integration Management Tutorial

- Planning and Control Tutorial

- Program Management Principles Tutorial

- program strategy Alignment Tutorial

- PMP Tutorial

- Program Governance Tutorial

- Program Life Cycle Management Tutorial

- PMP Exam Preparation Tutorial

- PMI-PgMP Tutorial

- Agile Methodologies and Frameworks- Kanban and Lean Management Tutorial

- JIRA Tutorial

- Primavera P6 Tutorial

Identify Risk Categories in Project Management | A Comprehensive Tutorial

Last updated on 24th Aug 2022, Blog, Project Management, Tutorials

Introduction of Risk Categories:

Every investor has an individual risk profile that determines their willingness and ability to withstand risk.In general, as investment risks rise, investors expect larger returns to compensate for taking those risks.A fundamental idea in finance is the relationship between risk and return.The greater the amount of risk an investor is willing to take, the greater the potential return.Risks can come in different ways and investors need to be compensated for taking on additional risk.For example, a U.S. Treasury bond is considered one of the safest investments and when compared to a corporate bond, offers a lower rate of return.A corporation is more likely to go bankrupt than the U.S. government.. A high standard deviation denotes a lot of value volatility and therefore a high degree of risk.Individuals, financial advisors, and companies can all develop risk management strategies to help manage risks associated with the investments and business activities.Academically, there are some theories, metrics, and strategies that have been identified to measure, analyze, and manage risks Some of these contain below:

- Standard deviation, beta,

- Value at Risk (VaR),

- The Capital Asset Pricing Model (CAPM).

Measuring and quantifying risk often allows investors, traders, and business managers to hedge some risks away by using different strategies including diversification and derivative positions.

What are Risk Categories?

The term “risk categories” refers to the risk groups that have been generated on the basis of the business activities of the organization. These risk categories offer a structured overview of the potential risks to which the specific organization is exposed.Some of the most generally used risk categories include risks are:

- Pertaining to operations,

- Business,

- Resource,

- Regulatory,

- People ,

- Project .

Explanation of Risk Categories:

In general, businesses face a wide range of hazards, some of which are so severe that they threaten the very existence of the company.As such, most of the high companies set-up extensive risk management departments, while the smaller firms may hire one or two risk professionals to manage all of the risks.Nevertheless, categorization of risks is the very first step or the foundation of the risk management strategy in any of the companies.

Categories of Risk:

Some of the most general categories of risks are usually observed across companies.However, note that the list is not exhaustive and some of them can also be clubbed together into an individual risk category.

Operational Risk: It can be explained as the risk that can arise due to inefficiencies in business operations or improper implementation of business processes.In some cases, even external issues, like government regulations, weather problems, etc.,can also result in operational risks.

Business Risk: This type of risk can occur due to different process related issues, which may include a shortage of purchase orders, delay in receiving inputs from clients, etc.

Schedule Risk: This risk refers to an incorrect assessment of the accomplishment or release of a project.Schedule risk can force a project to such an extent that it can also become the sole reason for its failure.

Budget Risk: It can be explained as the risk arising out of grossly inaccurate estimation of the budget for a specific process or project.Budget risk can result in a delay in project completion, premature handover of the project or compromised the project quality. Budget risk is also known as the cost risk.

Information Security Risk: It can be explained as the risk arising out of breach of confidentiality of any sensitive data, especially financial data.The implication of violation of this kind might not be restricted to financial losses as it can severely dent the reputation and goodwill of an organization.

Supplier Risk: It can be explained as the risk due to too much dependence on one or very few suppliers.Such risks can force the company’s production process or influence the progress of its ongoing projects.

Technical Environment Risk: It can be explained as the risk that is pertaining to the environment in which the clients and the customers can operate.Some of the reasons behind risk due to the technical environment contain regular fluctuations in production, testing environment, etc.

Programmatic Risk: This type of risk is usually beyond the purview of operational limits and hence cannot be controlled or programmed.Some of the general examples of programmatic risks are changes in government regulations or product strategy.

Technology Risk: This type of risk occurs due to sudden or complete change in the strategy pertaining to technology or implementation of a new technology.Usually, people tend to resist such changes, which is one of the main manifestations of this risk.

Resource Risk: This type of risk occurs due to an inability of the company’s management to allocate and utilize the available resources, like employees, equipment, etc., appropriately.

Infrastructure Risk: This type of risk arises out of inefficient planning pertaining to infrastructure resources.As such, it is more important for any company to devise appropriate infrastructure planning for its project.

Architectural Risk: It can be explained as the risk of failure of the overall performance or functioning of an organization owing to the unsuccessful implementation of the software & hardware tools.

Process Quality Risk: This kind of risk occurs due to the failure to properly customize the business process.For instance, if a company hires staff that is not properly trained for the process, then there is a higher probability that the company’s process quality may get compromised.

Project Planning: It can be explained as the risk that arises out of improper planning for a specific project.Such risks can cause the project to sink as it might fail to meet a client’s expectations.

Grouping Risk Categories:

After identified all risks ,should group them together.Suggested groups are could be:

Technical Risk Categories:

Technical risks are those that cause an organization’s full functioning and performance to fail.These risks develop due to the failure of software and hardware tools and equipment used in a particular project.The risk for this category may be due to the capacity, Suitability, usability, Familiarity, Reliability, System Support, and deliverability.

- Team Communication

- Quality Assurance

- Architecture

Management Risk Categories:

Management risk occurs due to an inefficient resource management.Which is why it is always need to have appropriate management planning in place to ensure that the project does not suffer any of the consequences.

- Resourcing

- Budgeting

- Other Projects

Commercial Risk Categories:

Commercial risks broadly covers all non-political risks.Completion and financing risks, for example, exist during the software development phase.From the perspective of a company, commercial risks are non-payments by the private sector buyers due to the default, insolvency, and failure to use software developed an under the contract.Commercial risks harm project costs and revenue streams, and can put a project’s commercial viability in the jeopardy0.

- Contractual

- Partnerships

- Suppliers

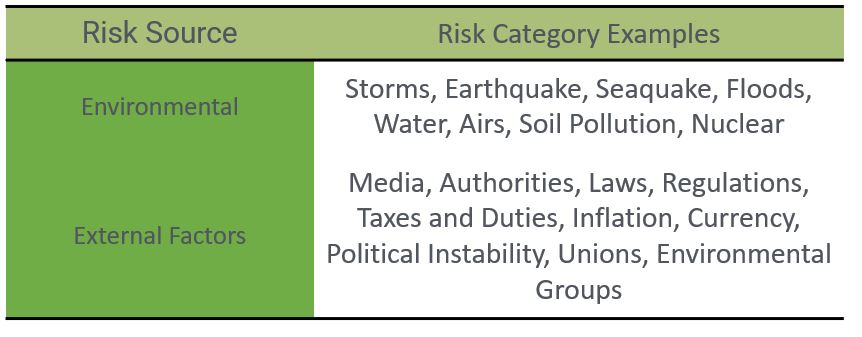

External Risk Categories:

External risks often contain economic events that arise from outside the corporate structure.External events that result in external risk are impossible for a company to control or predict with more accuracy.As a result, lowering the associated risks is complex.Economic factors, natural factors, and political factors are the 3 types of an external risks.

- Weather

- Regulations

- Facilities

Why do you use Risk Categories?

- Risk categories help identify the risks and enable them to become a robust and practical at the same time.

- It ensures that the users can trace the origin of the underlying and potential risks faced by the organization.

- These categories help to find the efficiency of the control systems implemented in all the departments of an organization.

- It ensures that the risk identification is made comprehensively, covering all the probable aspects of an underlying and upcoming risk conditions.

- With these categories, users can find the areas that are highly prone to risks, and it even permit for the identification of standard and probable causes.

- With risk categories, users can even develop the appropriate risk of dealing mechanisms.

How to Use Risk Categories:

- So, by now know what type of risks a business could face during its course of operation.

- However, just knowing about the risks is not of much use as long as ,do not convert it into the some actionable tasks.

- Risk categorization is the just first step of a well-engineered risk management strategy and there is a much more work to be done after that.

- The following steps contain deep diving into each kind of risk, analyzing them, identifying what are the particular things that could possibly go wrong, and then assessing their business impact.

- After all these steps, can finally built the strategy for the mitigating of risks.

Conclusion:

So, it is important to note that there may be some degree of an overlap between some of the risk categories based on the individual perception and judgment.Also, this is not an exhaustive list and there can be high risks associated with the businesses.Nevertheless, the point is that a company require to identify which are the most important risks for their business and then act accordingly to built a robust risk management strategy.