Business Analyst vs Financial Analyst | Know Their Differences and Which Role is Better ?

Last updated on 02nd Nov 2022, Artciles, Blog

- In this article you will get

- 1.Overview of Business Analyst

- 2.Overview of Financial Analyst

- 3.Job Description: Business Analyst vs. Financial Analyst

- 4.Roles and Responsibilities: A Business Analyst and Financial Analyst

- 5.Skills Comparison

- 6.Career Path: What is Your Choice?

- 7.Conclusion

Overview of Business Analyst

Business Analysts are professionals who connect the clients of an organization with IT professionals. These professionals are collaborate with executives in various departments to identify business problems and provide a technical solutions. Apart from this, they monitor ongoing a business processes, make changes at an organization level, and develop a software systems.

Overview of a Financial Analyst

Financial Analysts working in the organization collect financial data, analyze them and make decisions on in investment process. They maintain a spreadsheets of finance-related data to maintain a record of all the investments and financial transactions. They also model accounting theses and communicate with the investors. Also, FAs analyze a profit and loss of the company.

Job description of a Business Analyst

Business Analysts are be adaptable and play a variety of functions in different businesses. The job description for Business Analyst varies depending on department. A Business Analyst in the technical team, for instance, is responsible fora monitoring and updating systems, whereas in a sales team they are responsible for resolving the customer queries and taking feedback from them.

A Business Analyst is the superset for terms:

- Data Analyst

- Enterprise Analyst

- Business consultant

- Marketing analyst

- Product manager

- Requirements manager

- System analyst, and many other job roles.

Job description of a Financial Analyst

The job description of Financial Analyst is the same in most companies with the few exceptions. Financial Analysts analyze a financial and business performance of organization to anticipate future changes. These professionals are assist the management by providing a data-driven reports to make the strategic and informed decisions.FAs work on investments, analyse them and improve financial status of company. In some organizations, these analysts work solely for business and a few companies hire them to work on a market research and the other financial aspects.

A Financial Analyst is umbrella term for,

- Portfolio Manager

- Investment Analyst

- Risk Analyst

- Fund Manager

Rating Analyst, and many other analysts working in finance domain.

Financial Analysts are categorized into the 2 types: buy-side analysts and sell-side analysts.

Buy-side analyst: For firms with the lot of money to invest, buy-side analysts create investment plans. Hedge funds, insurance firms, independent on money managers, and charitable groups with the substantial endowments, like some colleges, are examples of institutional investors.

Sell-side analyst: Financial services sales are agents who sell stocks, bonds, and recommend other assets are sell-side analysts.Some analysts work for the business publications or research firms that are separate from purchase and sell sides.

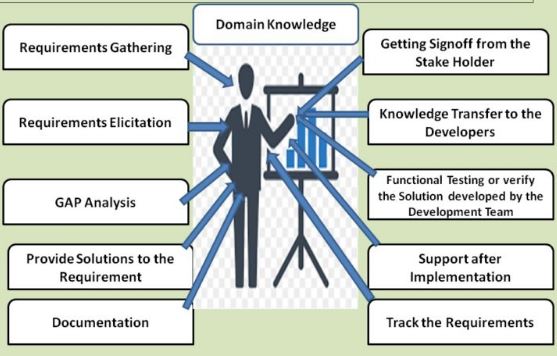

Roles and Responsibilities: Business Analyst and Financial Analyst

| Business Analyst | Financial Analyst |

|---|---|

| Identify areas for an improvement and put technical solutions in place | Work to improve financial performance by analyzing forecasts, variance, trends in the financial results |

| Modernizing and automating an existing systems | Be updated with latest technology in a financial instruments, and other market conditions |

| Provide management and the other teams with a plan of action | Model financial strategies to evaluate, plan and forecast investment problems |

| Collaborate with the clients, the IT department, and management personnel | Collaborate with the team members to capitalize a budgets and plan expenditures |

| Ensure cost-effectiveness and resource allocation | Create activities and policies that will help boost for the financial growth |

| Performance monitoring and also project management | Explore different investment strategies. |

| Obtain information from variety of stakeholders to offer valuable reports | Prepare reports based on financial data gathered and share findings with rest of the company |

| Analyse current business processes and devise improvement solutions | Analyze and compare market research to an improvise internal finances |

| Keep track of the corporate processes and anticipate future needs/problems | Revise existing financial data by a cross-checking the dataflows |

Both professionals have same work except for working in various domains. Business Analysts work in operations and management sector while Financial Analysts work in a finance sector. A Business Analyst works on overall development of business while a Financial Analyst works for an improvement of financial processes.

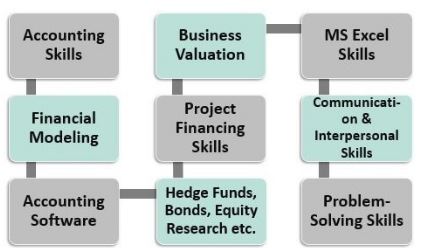

- Skills Comparison

- Interpersonal skills

- Communication skills

- Problem-solving skills

- Technical skills

- Leadership and management skills

- Critical thinking

- Organizational

- Analytical skills

| Business Analyst Skills | Financial Analyst Skills |

|---|---|

| Need to be skilled in a Microsoft Office (Word, Excel, and PowerPoint) | Ability to an operate autonomously |

| Maintain the team-oriented and collaborative atmosphere with the feeling of leadership | Experienced in working with and presenting to the senior executives |

| A high level of technical knowledge is needed | Experienced in a financial modelling |

| A thorough grasp of structure of an organization procedures is required | Ability to the simplify processes, as well as a desire to learn and also improve |

| Possess capacity to deliver presentations and write a reports based on the results of analysis | Excellent communication and presentation abilities, as well as ability to connect with the senior management |

Career Path: What is Choice?

Career Path:Business Analysts

Traditional Business Analysts are advance to

- 1.Senior Business Analyst

- 2.Business Architect

- 3.Senior Business Architect

In agile framework, may progress from BA to

- 1.Product Owner

- 2.PMO director

- 3.Vice President

- 4.Senior Vice President

- 5.Chief Information Officer

A Business Systems Analyst may be advance to a

- 1.Senior Analyst

- 2.Technology Architect

- 3.Enterprise Architect

Can go from a Project Manager to

- 1.Senior Project Manager

- 2.Program Manager

- 3.Business Owner and so on

Anyone pursuing a role of a Business Analyst can move the laterally from one department to another with a specific skills required for that particular department or advance in their profile.To go from senior BA to a Business Architect need to shift from tactical to the strategic thinking, from internal to outside emphasis, and a holistic view of company. To transition from a BA to Product Owner, need to build a new leadership abilities, a customer-centric mindset, and decision-making power.To provide a more value to the business, need to go outside the box and holistically think and advance up the corporate ladder.

Career Path: Financial AnalystAt an initial stage of the career, a Financial Analyst is guided by the Senior Financial Analyst. Most of professionals tend to pursue graduation in the said field, after few years of experience as a Financial Analyst.For proceeding to more advanced roles, a professional is expected to have the Master’s degree or take up courses to carry out many more responsibilities. A postgraduate with the few years of work experience can jump off to post of Senior Financial Analyst.

With strong competence and many years of experience, Senior Financial Analysts proceed to more for authoritative positions. These professionals hold the management positions, such as portfolio managers or fund managers who lead a group of a senior analysts. Also, these analysts can shift to the higher levels in management sector.In few companies, the senior analysts oversee and lead a working groups within their domains. These professionals are called Treasury Managers. A Financial Analyst achieves topmost position in career ladder as the Chief Financial Officer or Chief Investment Officer. They oversee an entire portfolio of company.

Conclusion

The profession of Business Analyst is a broad career diving into various sectors and hence, has ample opportunities ahead. A Financial Analyst, on other hand, is a confined option. But one gets skilled exponentially in the accounting and finance which provides a prospect of growth.

Are you looking training with Right Jobs?

Contact Us- Business Analyst Tutorial

- Introduction to Business Analytics with R Tutorial | Ultimate Guide to Learn

- Can Business Analyst be a Project Manager? : Expert’s Top Picks

- Business Analyst : Job Description | All you need to know [ Job & Future ]

- What does an Agile Business Analyst do | Required Skills, Roles and Responsibilities [ Job & Future ]

Related Articles

Popular Courses

- Hadoop Developer Training

11025 Learners - Apache Spark With Scala Training

12022 Learners - Apache Storm Training

11141 Learners

- What is Dimension Reduction? | Know the techniques

- Difference between Data Lake vs Data Warehouse: A Complete Guide For Beginners with Best Practices

- What is Dimension Reduction? | Know the techniques

- What does the Yield keyword do and How to use Yield in python ? [ OverView ]

- Agile Sprint Planning | Everything You Need to Know