- Cryptography Tutorial: What is Cryptanalysis, RC4, and CrypTool [OverView]

- Best Ethical Hacking Tools & Software for Hackers Tutorial | Ultimate Guide to Learn [UPDATED]

- Splunk Enterprise Security Tutorial | Get all the Reviews, Ratings, and Features

- CyberArk Tutorial | For Beginners [ STEP-IN ]

- Types of Wireless Attacks Tutorial

- CISSP – Asset Security Tutorial

- Information Security Governance Tutorial

- Encryption Techniques Tutorial

- IT Threats And Attacks Tutorial

- CISSP

- CISA – Protection of Information Assets Tutorial

- Security Implications Tutorial

- Information Security Management Tutorial

- WebGoat Tutorial

- Steganography Tutorial

- Actimize Tutorial

- Advanced Ethical Hacking – Burpsuite Tutorial

- Cybersecurity Tutorial

- BIOMETRICS Tutorial

- Ethical Hacking Tutorial

- Cryptography Tutorial: What is Cryptanalysis, RC4, and CrypTool [OverView]

- Best Ethical Hacking Tools & Software for Hackers Tutorial | Ultimate Guide to Learn [UPDATED]

- Splunk Enterprise Security Tutorial | Get all the Reviews, Ratings, and Features

- CyberArk Tutorial | For Beginners [ STEP-IN ]

- Types of Wireless Attacks Tutorial

- CISSP – Asset Security Tutorial

- Information Security Governance Tutorial

- Encryption Techniques Tutorial

- IT Threats And Attacks Tutorial

- CISSP

- CISA – Protection of Information Assets Tutorial

- Security Implications Tutorial

- Information Security Management Tutorial

- WebGoat Tutorial

- Steganography Tutorial

- Actimize Tutorial

- Advanced Ethical Hacking – Burpsuite Tutorial

- Cybersecurity Tutorial

- BIOMETRICS Tutorial

- Ethical Hacking Tutorial

Actimize Tutorial

Last updated on 27th Sep 2020, Blog, Cyber Security, Tutorials

NICE Actimize, the industry’s largest and broadest provider of financial crime, anti-money laundering, enterprise fraud and compliance solutions is the leader in Autonomous Financial Crime Management. The Autonomous journey begins with NICE Actimize’s ActOne which fundamentally transforms financial crime investigations by introducing intelligent automation and visual storytelling for speed and accuracy. Intelligent automation saves time by enabling a virtual workforce of robots to collaborate with human investigators, while visual storytelling uncovers more risks by showing relationships between entities, alerts and cases in a visual manner. The Autonomous path continues with the release of X-Sight, NICE Actimize’s cloud-based Financial Crime Risk Management Platform-as-a-Service that breaks the limits on data and analytics by leveraging the cloud.

As the task of fighting financial crime becomes more challenging, we deploy increasingly sophisticated technology that finds anomalous behavior both earlier and faster. These technology advancements and the resulting enhanced detection serve to positively impact your business and your customer’s experience. As a responsive business partner, our goal is to ensure that Actimize’s technology innovations help you:

- Eliminate financial losses from theft, fraud, regulatory penalties, and sanctions

- Decrease operational costs to investigate and research suspicious activity

- Improve customer experience with fewer disruptions in service

- Adapt to changing business needs and regulatory requirements

Open Analytics

Agility is critical as threats and regulations constantly change

Today your organization faces a highly competitive business environment, a dynamic and increasingly rigorous regulatory environment, and a constantly shifting threat landscape.

Open analytics put your users in the driver’s seat

Actimize open analytics gives your users the control they need to respond quickly to challenges and meet your organization’s unique business needs. Out-of-the-box analytics combine with user-defined analytics, rules, policies, and workflows for comprehensive coverage and flexibility. The highly flexible and scalable Actimize platform and our easy-to-use development tools allow your users to take charge.

Big Data

Overwhelming amounts of data can dominate your business

Your organization faces an increase in the volume, velocity, variety, and variability of data. Along with rising data management costs, this puts your organization’s ability to stay on top of the data challenge at risk.

Strike the right balance between data management and business value

Investigator productivity should not suffer under the weight of increased alerts generated by growing amounts of data. Actimize enables you to perform better detection and enhanced investigation amidst a growing sea of data coming in from an increasing number of sources in a variety of formats so your organization can benefit from the world of big data rather than being smothered by it.

Business Intelligence & Visual Analytics

Static, retrospective reports don’t give you an accurate view of risk

Financial Services Organizations grapple with access to timely and readily available reporting that helps them answer questions about the current state of risk, trends, and patterns. They are reliant on IT and therefore subject to IT’s backlog of requests, making change happen slowly, and inhibiting organizations’ ability to be proactive in managing risk.

Real-time, business-friendly data visualization and industry leading report packs

Take charge of your risk management. NICE Actimize Visual Analytics grants teams the ability to get real-time actionable insights to proactively mitigate risk. In addition to allowing business users to create meaningful and easy-to-understand visualizations (instead of waiting for IT), our prepackaged Insight Packs allow teams to leverage industry-leading reports and dashboards to visualize, explore, and take action on data faster than ever.

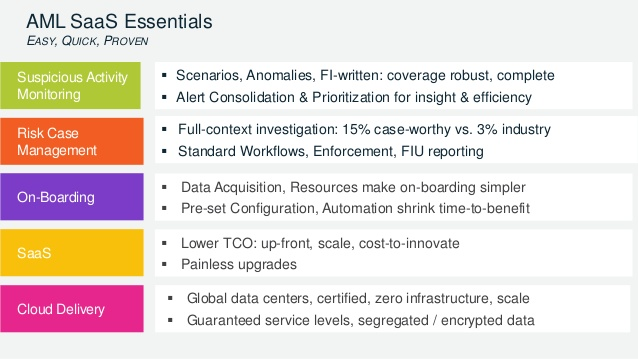

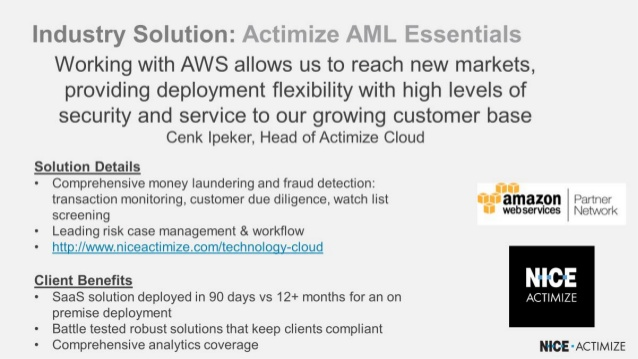

AML Essentials

Regardless of your financial service organization’s size, AML compliance requirements are complicated and time consuming.

Actimize AML Essentials, a cloud-based offering that is built upon our proven, industry-leading, end-to-end anti-money laundering platform addresses the challenges of regional and community financial institutions. Essential AML coverage includes Transaction Monitoring, Customer Due Diligence, and Sanctions Screening.

Leveraging X-Sight DataIQ, financial institutions can enrich customer and counterparty risk profiles with the latest intelligence from 100s of external data sources. These integrated insights allow firms to take on a new level of customer centricity and quickly act on opportunities and threats throughout the customer lifecycle – without compromising on compliance and client satisfaction.

Using the same power and experience as our enterprise solutions, AML Essentials offers rapid deployment and reduces overhead to make compliance easier and at a lower total cost of ownership.

Subscribe For Free Demo

Error: Contact form not found.

NICE Actimize Essentials can be rapidly deployed on AWS

- At NICE Actimize, the goal is to help community and regional financial institutions optimize their approach to financial crime management by integrating anti-money laundering (AML) compliance and fraud prevention capabilities on a single cloud-based platform.

- Increase synergy and operational efficiency, lower costs, and address emerging threats and industry changes

- Intelligent analytics: Technology such as advanced analytics and anomaly detection can improve alert quality and significantly reduce false positives

- Comprehensive coverage against financial crime: Proactively manage end-to-end AML and fraud risks by intelligently and efficiently correlating financial crime activities to help support cost-effective operations and a positive, holistic customer experience

- Collaborative investigative tool: Our Detection and Research Tool (DART) uses the solution’s collaboration and analysis features to enable self-service investigations

- Integrated case management: Investigate and prepare cases from a single interface with role-based dashboard views and integrated workflow management, which provides efficient alert management, ad-hoc investigation, management reporting, and full audit tracking

- Rapid deployment: NICE Actimize Essentials offers organizations several out-of-the-box detection analytics and tuning tools built with industry best practices, helping to accelerate solution deployments

- Actimize Essentials policy manager: Create new detection rules with a simple and intuitive interface that allows for quick responses to new regulatory changes and new types of AML and fraud attacks

Invesigation and management

- NICE Actimize ActOne

- A One-for-All Intelligent Investigation Platform

- Managing risk and investigations is more complex and costlier than ever before. That’s why organizations are demanding a new approach to alert and case management that enables their analysts and investigators to reduce investigation time, while improving decision makin

- NICE Actimize’s ActOne fundamentally transforms financial crime investigations by introducing intelligent automation and visual storytelling for speed and accuracy. Intelligent automation saves times by enabling a virtual workforce of robots to collaborate with human investigators, while visual storytelling uncovers more risks by showing relationships between entities, alerts and cases in a visual manner.

Benefits of ActOne:

- 1. Empower smarter decision making through entity-driven investigations and visual analytics

- 2. Help humans focus on knowledge work while robots perform manual, repetitive tasks

- 3. Expedite investigative decisions with a dynamic risk value for every entity

- 4. Drive collaboration with real-time notifications on all analyst and robot actions

- 5. ActOne unifies financial crime, risk and compliance programs and provides purpose-built capabilities that drive operational efficiencies. Organizations are able to standardize and centralize risk and compliance programs on one platform, regardless of business unit, risk type or geography, as well as use a combination of intelligent automation and visual storytelling to help teams focus on faster decision-making and entity risk – meaning more accurate investigations and efficient operations.

- 6. ACTone leverages AI combined with analytics and automation to aid in financial crime detection, investigations, and operations process. This approach relies on NICE’s Autonomous Financial Crime Management product, which enables financial services companies to deploy robots to collaborate with human investigators to more efficiently tackle financial crime investigations.

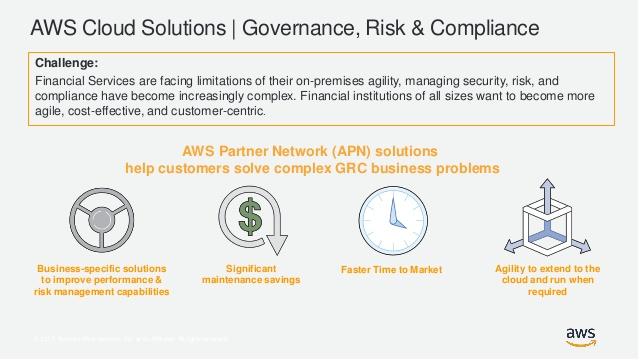

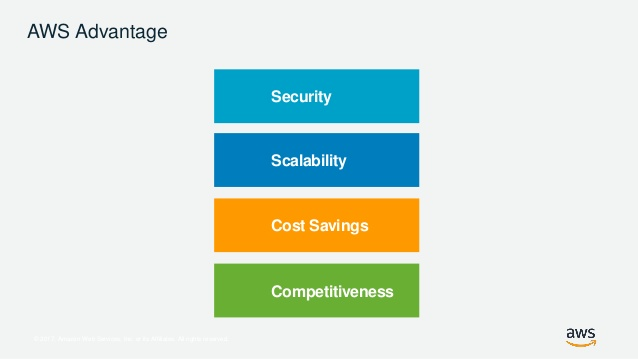

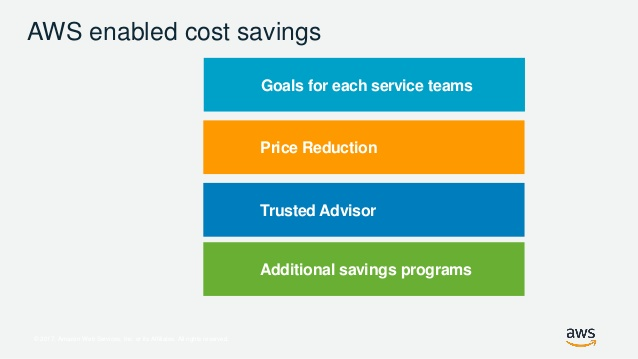

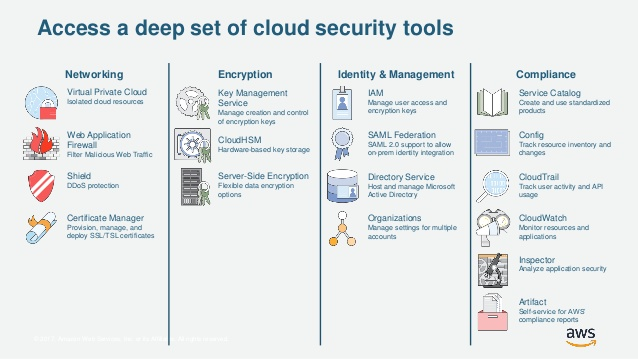

AWS advantages

The new investigation manager tool suite includes:

- Entity Insights: offers visual relationships across entities and helps uncover risks and reveal deeper insights;

- Virtual Workforce: eliminates manual data gathering and reduces costs and errors with robotics process automation;

- Entity Risk: assigns a dynamic risk score to every entity using machine learning to make faster decisions;

- Activity Centre: provides instant notifications on changes made to cases or work items;

- Visual Storytelling and Modern User Experience: offers intuitive navigation with graphical data representations to provide instant insights.

NICE Actimize internal and external compliance solutions for cloud

Key features

Beat the silo-based approach with complete integration, greater transparency, and centralized information sharing

Consistent risk management: Essentials offers end-to-end financial crime prevention on a single, integrated core risk platform, creating consistent processes across the whole program and offering a broad view of risk

Detection rate: NICE Actimize helps to lower false positives and provides a detection rate greater than 80 percent with a unique combination of out-of-the-box rules and advanced anomaly detection

Model governance made easy: This solution provides deep visibility and transparency into detection logic and risk scoring techniques of AML and fraud models, saving many hours of defending models to the regulators

Holistic view of risk: Essentials unifies data and intelligence from financial crime, risk, and compliance processes to present comprehensive stories for faster and more precise resolution

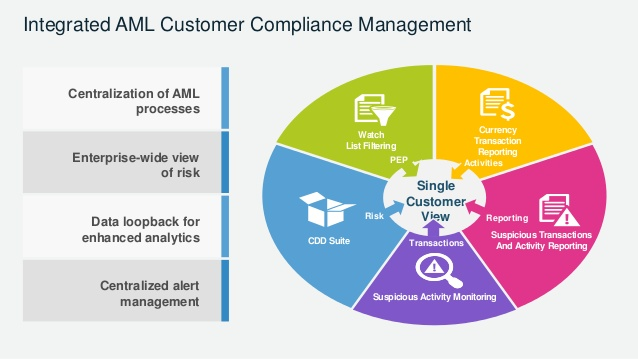

How It Works NICE Actimize includes two solution areas:

1. Anti-Money Laundering (AML) – The AML solution enables integrated AML lifecycle management that delivers insight across the breadth of customer activities, maintaining cost-effective AML operations as well as a positive, holistic customer experience.

2. Fraud Detection & Prevention – The Actimize platform provides effective management of fraud and cyber threats to help you increase operational efficiency while reducing chances for your loss and reputational damage.

Challenges

Financial institutions that support both investors and consumers face increasingly complex regulations with which they must comply to safeguard their clients. As risks to financial services organizations and their customers grow and change, a consolidated, comprehensive approach to financial crime risk management will provide the greater risk and compliance coverage needed to keep pace with an ever-changing marketplace.