- Understanding Agile Methodologies and Principles | A Complete Tutorial

- What is a Work Breakdown Structure (WBS)? | Learn Overview, Steps, Benefits

- Traditional Project Management Tutorial | A Comprehensive Guide

- Total Quality Management (TQM): Complete Guide [STEP-IN]

- Total Productive Maintenance Tutorial | Get an Overview

- Virtual Team Tutorial – Learn Origin, Definition and its Scope

- The Rule of Seven in Project Management – Tutorial

- Make or Buy Decision – A Derivative Tutorial for Beginners

- What is Halo Effect? | Learn More through Tutorial

- Balanced Score Card Tutorial | Learn with Definition & Examples

- What is Supply Chain Management? | Tutorial with Examples

- Succession Planning Tutorial | A Complete Guide with Definitions

- What is Structured Brainstorming? | Quickstart & Learn the Tutorial

- Stress Management Tutorial | A Comprehensive Guide for Beginners

- What is a Statement of Work? | Learn with Definition & Examples

- What is Stakeholder Management? – The Ultimate Guide for Beginners

- How to Create a Staffing Management Plan? | Learn from Tutorial

- What is Resource Leveling? | A Comprehensive Tutorial

- Requirements Collection Tutorial: Gather Project Needs

- What Is a RACI Chart? | Learn with Example & Definitions

- Quality Assurance vs Quality Control: Tutorial with Definitions & Differences

- Project Workforce Management Tutorial | A Definitive Guide

- Project Time Management Tutorial: Strategies, Tips & Tools

- Project Management Success Criteria Tutorial | Understand and Know More

- Identify Risk Categories in Project Management | A Comprehensive Tutorial

- Project Records Management Tutorial | Quickstart -MUST READ

- Project Quality Plan (PQP) Tutorial | Ultimate Guide to Learn [BEST & NEW]

- Project Portfolio Management | A Defined Tutorial for Beginners

- Goals of a Project Manager Tutorial | The Ultimate Guide

- Project Management Triangle Tutorial: What It Is and How to Use

- Project Management Tools Tutorial | Learn Tools & Techniques

- What is PMO (project management office)? | A Complete Tutorial from Scratch

- Project Management Lessons | Learn in 1 Day [ STEP-IN ]

- What is a Project Kickoff Meeting? | Learn Now – A Definitve Tutorial

- Project Cost Management Tutorial | Steps, Basics, and Benefits

- Types of Contracts in Project Management | Learn with Examples

- Project Activity Diagram | Ultimate Guide to Learn [BEST & NEW]

- What is Project Procurement Management? | Tutorial Explained

- Procurement Documents Tutorial | The Ultimate Guide

- Process-Based Project Management Tutorial: A Beginner’s Guide

- What Is PRINCE2 Project Management? | A Definitive Tutorial for Beginners

- Effective Presentation Skills – Learn More through Tutorial

- Powerful Leadership Skills Tutorial | The Ultimate Guide

- PERT Estimation Technique Tutorial | Explained with Examples

- Pareto Chart Tool Tutorial | Learn Analysis, Diagram

- Organizational Structure Tutorial: Definition and Types

- Negotiation Skills for Project Management | Learn from the Basics

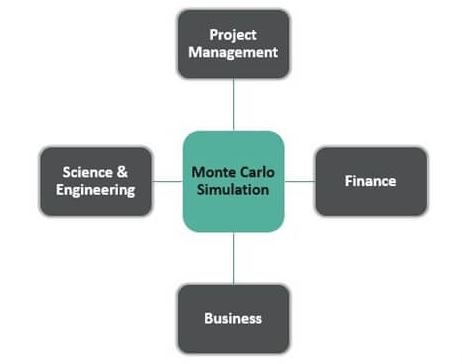

- Monte Carlo Analysis in Project Management Tutorial | A Perfect Guide to Refer

- Effective Management Styles Tutorial | The Ultimate Guide

- Management by Objectives (MBO) Tutorial | Overview, Steps, Benefits

- Leads, Lags & Float – Understand the Difference through Tutorial

- What is Knowledge Management? – Tutorial Explained

- What is Just-in-Time Manufacturing (JIT)? | Know More through Tutorial

- Gantt Chart Tool Tutorial: The Ultimate Guide

- Extreme Project Management Tutorial – Methodology & Examples

- Introduction for Event Chain Methodology Tutorial | Guide For Beginners

- Enterprise Resource Planning (ERP) | A Complete Tutorial for Beginners

- What Is Design of Experiments (DOE)? | Learn Now – A Definitve Tutorial

- Decision Making Tutorial – Know about Meaning, Nature, Characteristics

- Critical Path Method Tutorial | How to use CPM for project management

- What is Critical Chain Project Management? | A Complete Tutorial

- What is Conflict Management? | Learn the Definition, styles, strategies through Tutorial

- Effective Communication Skills Tutorial – Definitions and Examples

- Communication Models Tutorial – Project Management

- Methods of Communication Tutorial | A Complete Learning Path

- Communication Management Tutorial | Know more about Plans & Process

- What are Communication Channels? | Learn Now Tutorial

- Communication Blocker Tutorial | Explained with Examples

- Cause and Effect Diagrams Tutorial | The Ultimate Guide

- What is Benchmarking? | Technical & Competitive Tutorial

- Seven Processes of Prince2 Tutorial | Everything you Need to Know

- Design Thinking Tutorial – Quick Guide For Beginners

- What is Performance Testing | A Complete Testing Guide With Real-Time Examples Tutorial

- What is Confluence? : Tutorial For Beginners | A Complete Guide

- Lean Six Sigma Tutorial

- Agile Scrum Tutorial

- PMI-RMP Plan Risk Management Tutorial

- Designing the Blueprint Delivery Tutorial

- What is Confluence? : Tutorial For Beginners | A Complete Guide

- Program Benefits Management Tutorial

- Continuous Improvement – Agile Value Stream Mapping

- Program Organization Tutorial

- Risk and Issue Management Tutorial

- Project Integration Management Tutorial

- Planning and Control Tutorial

- Program Management Principles Tutorial

- program strategy Alignment Tutorial

- PMP Tutorial

- Program Governance Tutorial

- Program Life Cycle Management Tutorial

- PMP Exam Preparation Tutorial

- PMI-PgMP Tutorial

- Agile Methodologies and Frameworks- Kanban and Lean Management Tutorial

- JIRA Tutorial

- Primavera P6 Tutorial

- Understanding Agile Methodologies and Principles | A Complete Tutorial

- What is a Work Breakdown Structure (WBS)? | Learn Overview, Steps, Benefits

- Traditional Project Management Tutorial | A Comprehensive Guide

- Total Quality Management (TQM): Complete Guide [STEP-IN]

- Total Productive Maintenance Tutorial | Get an Overview

- Virtual Team Tutorial – Learn Origin, Definition and its Scope

- The Rule of Seven in Project Management – Tutorial

- Make or Buy Decision – A Derivative Tutorial for Beginners

- What is Halo Effect? | Learn More through Tutorial

- Balanced Score Card Tutorial | Learn with Definition & Examples

- What is Supply Chain Management? | Tutorial with Examples

- Succession Planning Tutorial | A Complete Guide with Definitions

- What is Structured Brainstorming? | Quickstart & Learn the Tutorial

- Stress Management Tutorial | A Comprehensive Guide for Beginners

- What is a Statement of Work? | Learn with Definition & Examples

- What is Stakeholder Management? – The Ultimate Guide for Beginners

- How to Create a Staffing Management Plan? | Learn from Tutorial

- What is Resource Leveling? | A Comprehensive Tutorial

- Requirements Collection Tutorial: Gather Project Needs

- What Is a RACI Chart? | Learn with Example & Definitions

- Quality Assurance vs Quality Control: Tutorial with Definitions & Differences

- Project Workforce Management Tutorial | A Definitive Guide

- Project Time Management Tutorial: Strategies, Tips & Tools

- Project Management Success Criteria Tutorial | Understand and Know More

- Identify Risk Categories in Project Management | A Comprehensive Tutorial

- Project Records Management Tutorial | Quickstart -MUST READ

- Project Quality Plan (PQP) Tutorial | Ultimate Guide to Learn [BEST & NEW]

- Project Portfolio Management | A Defined Tutorial for Beginners

- Goals of a Project Manager Tutorial | The Ultimate Guide

- Project Management Triangle Tutorial: What It Is and How to Use

- Project Management Tools Tutorial | Learn Tools & Techniques

- What is PMO (project management office)? | A Complete Tutorial from Scratch

- Project Management Lessons | Learn in 1 Day [ STEP-IN ]

- What is a Project Kickoff Meeting? | Learn Now – A Definitve Tutorial

- Project Cost Management Tutorial | Steps, Basics, and Benefits

- Types of Contracts in Project Management | Learn with Examples

- Project Activity Diagram | Ultimate Guide to Learn [BEST & NEW]

- What is Project Procurement Management? | Tutorial Explained

- Procurement Documents Tutorial | The Ultimate Guide

- Process-Based Project Management Tutorial: A Beginner’s Guide

- What Is PRINCE2 Project Management? | A Definitive Tutorial for Beginners

- Effective Presentation Skills – Learn More through Tutorial

- Powerful Leadership Skills Tutorial | The Ultimate Guide

- PERT Estimation Technique Tutorial | Explained with Examples

- Pareto Chart Tool Tutorial | Learn Analysis, Diagram

- Organizational Structure Tutorial: Definition and Types

- Negotiation Skills for Project Management | Learn from the Basics

- Monte Carlo Analysis in Project Management Tutorial | A Perfect Guide to Refer

- Effective Management Styles Tutorial | The Ultimate Guide

- Management by Objectives (MBO) Tutorial | Overview, Steps, Benefits

- Leads, Lags & Float – Understand the Difference through Tutorial

- What is Knowledge Management? – Tutorial Explained

- What is Just-in-Time Manufacturing (JIT)? | Know More through Tutorial

- Gantt Chart Tool Tutorial: The Ultimate Guide

- Extreme Project Management Tutorial – Methodology & Examples

- Introduction for Event Chain Methodology Tutorial | Guide For Beginners

- Enterprise Resource Planning (ERP) | A Complete Tutorial for Beginners

- What Is Design of Experiments (DOE)? | Learn Now – A Definitve Tutorial

- Decision Making Tutorial – Know about Meaning, Nature, Characteristics

- Critical Path Method Tutorial | How to use CPM for project management

- What is Critical Chain Project Management? | A Complete Tutorial

- What is Conflict Management? | Learn the Definition, styles, strategies through Tutorial

- Effective Communication Skills Tutorial – Definitions and Examples

- Communication Models Tutorial – Project Management

- Methods of Communication Tutorial | A Complete Learning Path

- Communication Management Tutorial | Know more about Plans & Process

- What are Communication Channels? | Learn Now Tutorial

- Communication Blocker Tutorial | Explained with Examples

- Cause and Effect Diagrams Tutorial | The Ultimate Guide

- What is Benchmarking? | Technical & Competitive Tutorial

- Seven Processes of Prince2 Tutorial | Everything you Need to Know

- Design Thinking Tutorial – Quick Guide For Beginners

- What is Performance Testing | A Complete Testing Guide With Real-Time Examples Tutorial

- What is Confluence? : Tutorial For Beginners | A Complete Guide

- Lean Six Sigma Tutorial

- Agile Scrum Tutorial

- PMI-RMP Plan Risk Management Tutorial

- Designing the Blueprint Delivery Tutorial

- What is Confluence? : Tutorial For Beginners | A Complete Guide

- Program Benefits Management Tutorial

- Continuous Improvement – Agile Value Stream Mapping

- Program Organization Tutorial

- Risk and Issue Management Tutorial

- Project Integration Management Tutorial

- Planning and Control Tutorial

- Program Management Principles Tutorial

- program strategy Alignment Tutorial

- PMP Tutorial

- Program Governance Tutorial

- Program Life Cycle Management Tutorial

- PMP Exam Preparation Tutorial

- PMI-PgMP Tutorial

- Agile Methodologies and Frameworks- Kanban and Lean Management Tutorial

- JIRA Tutorial

- Primavera P6 Tutorial

Monte Carlo Analysis in Project Management Tutorial | A Perfect Guide to Refer

Last updated on 24th Aug 2022, Blog, Project Management, Tutorials

Introduction:

Everything was named after the principality famous for its casinos. The phrase Monte Carlo Analysis brings up visions of a complex method for optimizing one’s winnings in a casino game. However, Monte Carlo Analysis refers to a project management approach in which a manager computes and assesses the overall project cost and project timeline several times. This is accomplished by the use of a set of input values chosen after careful consideration of probability distributions, potential costs, and potential durations.

Describe Monte Carlo?

Project managers utilize the Monte Carlo Analysis, a risk management tool, to determine the effects of various risks on the project cost and timeframe. This approach makes it easy to determine how the project schedule and budget will change if a risk occurs. It is utilized at various points during the project life cycle to acquire an understanding of a variety of likely outcomes under various situations.

Importance of the Monte Carlo Analysis:

Monte Carlo Analysis is more important in project management as it allows a project manager to calculate a probable total cost of a project as well as to find a range or a potential date of finishing for the project. Since a Monte Carlo Analysis used quantified data, this allows project managers to better communicate with the senior management. Especially when the latter is pushing for impractical project finishing dates or unrealistic project costs. Also, this type of an analysis permits the project managers to quantify the perils and ambiguities in project schedules.

Example of the Monte Carlo Analysis:

A project manager generates three estimates for the duration of the project: one being the more likely duration, one the worst case scenario and the other being the best case scenario. For every estimate, the project manager consigns the probability of occurrence.

Three tasks are involved in the project:

- The first task is likely to take 3 days (70% probability)

- But it can also be finished in 2 days or even 4 days.

- The probability of it taking 2 days to finish is 10% .

- The probability of it taking 4 days to finish is 20%.

- The second task has a 60% probability of taking 6 days to complete.

- A 20% probability of each being completed in 5 days or 8 days.

- The final task has an 80% probability of being finished in 4 days, 5% probability of being completed in 3 days ,

- A 15% probability of being completed in 5 days.

Using the Monte Carlo Analyze, a series of simulations are done on the project probabilities. The simulation is to run for a 1000 odd times, and for every simulation, an end date is noted. Once the Monte Carlo Analysis is finished, there would be no one project completion date. Instead the project manager has a probability curve depicting the likely dates of finishing and the probability of attaining each. Using this probability curve, the project manager informs the senior management of the expected date of the completion. The project manager chooses the date with a 90% chance of attaining it. It could be said that using the Monte Carlo Analysis, the project has a 90% chance of being finished in X number of days. Similarly, a project manager can adjudge the estimated budget for a project using probabilities to simulate various end results and in turn use the findings in a probability curve.

How is the Monte Carlo Analysis Carried Out?

The above example was one that contained a mere 3 tasks. In reality, such projects include hundreds if not 1000 of tasks. Using the Monte Carlo Analysis, a project manager is able to derive a probability curve to display the ambiguity surrounding the duration and the costs surrounding these 100 or 1000 of tasks. Conducting simulations involving 100 or 1000 of tasks is a tedious job to be done manually. Today there is project management scheduling software that can conduct thousands of simulations and provide the project manager various end results in a probability curve.

Monte Carlo Analysis – How it Works:

Let’s break down this strategy step by step.

- Each project’s tasks are assigned, and the data is put into the Monte Carlo automation.

- Different timelines are displayed by the tool such as the probabilities of completion of one task in a specific number of days .

- Now that the probable timelines of the different tasks are created, a number of simulations are done on these probabilities.

- The number of Monte Carlo simulation project management ranges in a some thousand and all of them create the end dates.

- Hence, the output of the Monte Carlo Analysis is not an individual value, but a PROBABILITY CURVE.

- This curve depicts the probable completion dates of different tasks and their probability values.

- This curve enables the project managers to come up with the most probable and intelligent schedule of the project completion and submit a credible report of a project timeline to the clients and more management.

By now ,I must have grasped why the Monte Carlo simulation in project management is the best technique to formulate the most credible project plans. Project costs and project schedules are vulnerable to different types of risks, such as a lack of resources. Monte Carlo, a risk management technique, is the best to tackle such types of risks. Hence, it is drawing the attention of more project managers with each passing day.

Monte Carlo Analysis – Benefits

- Provide objective and insightful data for decision making

- Empowers the project managers to generate a more practical project schedule and cost plan

- Better assessment regarding the project milestones

- Better assessment of cost overruns and schedule overruns

- Better risk quantification

Monte Carlo Analysis – Limitations:

- Initial calculation of the best-case scenario, the most likely scenario.

- And the worst-case scenario is done by the project manager.

- It works in the best possible manner if it offers pertinent values in the 1st place.

- So, if the incorrect data is entered, the evaluation procedure could go completely wrong.

- In project management, the Monte Carlo simulation applies to the entire project rather than to individual tasks.

So, before utilizing it, everything needs to be organized.

Probability Curves for Monte Carlo Analysis: Types and Interpretations:

1. Bell Curve or Normal Curve: The value in the middle of the curve has the maximum probability of an occurrence.

2. Lognormal Curve: It has asymmetric or skewed values that cannot go below zero and have an unlimited positive potential. Stocks, oil reserves and the real estate sectors have such curves.

3. Uniform Curve: All values have an equal odds of occurring. Most frequently, these curves appear in projections of future sales and manufacturing costs.

4. Triangular Curve: The manager inputs the best-case, worst-case, and the most-likely values.The curve displays the most likely odds for the most probable values. The PERT and Discrete curves are the other 2 types of curves. In PERT, values are not that more extreme, while individual probability in the Discrete Curve Distribution.

What is Monte Carlo famous for?

Monte Carlo is popular for being the best risk management technique in which different simulations are used to find out the odds of various outcomes in any project. which are otherwise very difficult to find, owing to random variables.The Monte Carlo Analysis is widely used to calculate the risks and uncertainty in forecasting and prediction models. The method is used to find out the odds of the occurrence of different events or risks or activities during the lifetime of a project. when a large number of random variables made it more tough to grasp the overall picture.

What is Cost-Benefit Analysis in Project Management?

A cost-benefit analysis (CBA) is a tool to calculate the costs vs. benefits in an important business proposal. A formal CBA lists the all project expenses and tangible benefits, then calculates the return on investment (ROI), internal rate of return (IRR), net present value (NPV), and payback period. Then, the difference between the costs and the benefits from taking action is estimated. A general procedure of thumb is the costs should be less than 50% of the benefits, and the payback period shouldn’t exceed a year. Some people also refer to the cost-benefit analysis as benefit-cost analysis (BCA).

What is a project management framework?

A project management framework is a gathering of tools, tasks, and processes used to organize and execute a project from start to finish. A framework outlines everything needed to plan, manage, and control the projects successfully.A standard project management framework can be broken down into 3 main buckets:

The project life cycle: A key difference between Waterfall and Agile methodologies is that their frameworks include various life cycles.

For instance, the Waterfall framework outlines these 5 standard phases:

- Initiation

- Planning

- Execution

- Control and monitoring

- Closure

An Agile project framework will likely use a modified life cycle to represent the flexible and iterative nature of the Agile better.

Templates, checklists, and other tools.

- Project framework includes the information needed to plan the project effectively, from recommendations on tasks, activities, and resources to draft project documents.

Processes and activities.

- Every framework will outline specific project processes to follow, so various frameworks work better for different projects.

- For instance, daily meetings are a regular activity in more Agile frameworks.

- The purpose of a project management framework is to offer a clear and consistent outline for projects – one that ensures reliable and repeatable execution of projects across teams and throughout the companies.

- Frameworks document and share best practices to benefit all.

- They also help organizations and industries generate common standards.

- The PMBOK Guide explains a framework as the basic structure for understanding project management.

- Project managers choose the framework that works best for the project or team .

- Describe how to select the appropriate framework for the project .

Difference between a methodology and a framework?

- A methodology outlines the project management principles, values, and best practices to follow, while a framework prescribes a path to follow them.

- A methodology tells what one wants to achieve, and a framework focuses on how to achieve it.

- For instance, Lean and Agile principles may indicate that responding to the change is vital.

- However, these methodologies don’t tell how to ensure the projects react well to change – this information is outlined in a framework.

Conclusion:

The Monte Carlo Analysis is an important method adopted by managers to estimate the many possible project completion dates and the most likely budget needed for the project. By Using the information gathered through the Monte Carlo Analysis, project managers are able to give the senior management the statistical evidence.